Mastering Real Estate Transaction Management

- Oct 10, 2025

- 18 min read

Getting a real estate deal from an accepted offer to a closed sale is a marathon, not a sprint. Real estate transaction management is the system that gets you across the finish line—it’s the combination of people, processes, and technology that keeps everything moving forward. Think of it as the operational backbone of every single deal.

What is Real Estate Transaction Management, Really?

Imagine a real estate closing is like an orchestra performance. You have the buyer, seller, agents, lender, and inspector—all skilled musicians. But without a conductor keeping time and cueing each section, you'd just have noise. Real estate transaction management is the conductor.

This isn't just about shuffling paperwork from one desk to another. It’s the hands-on job of steering every detail, deadline, and legal hurdle involved in transferring a property's title. It’s how you turn a chaotic mess of tasks into a predictable, step-by-step workflow.

More Than Just Paperwork

At its heart, transaction management is built on three pillars. If any one of them crumbles, the whole deal can get delayed or fall apart completely.

Process Coordination: This is the game plan. It’s about creating and sticking to a detailed checklist for everything—opening escrow, booking the home inspection, chasing down loan approval, and scheduling that final walkthrough.

Document and Compliance Oversight: This is non-negotiable. Every contract, addendum, disclosure, and report needs to be perfectly filled out, signed, and filed according to strict legal and brokerage rules.

Stakeholder Communication: Keeping everyone in the loop is critical. When clients, the other agent, the lender, and the title officer get regular, clear updates, it kills confusion and builds the trust you need to get to closing.

A well-managed transaction isn’t just about being efficient—it’s about managing risk. When you obsessively track dates and documents, you’re building a bulletproof file that protects your clients, yourself, and your brokerage from legal trouble later on.

Why This Matters So Much

In a crowded market, the client experience you provide is what sets you apart. Solid transaction management creates a smooth, professional, and transparent journey for buyers and sellers, taking the anxiety out of one of the biggest financial decisions they'll ever make.

This organized approach also makes a huge difference in an agent's or team's bottom line. When you’re not constantly putting out fires or hunting for signatures, you can focus on what actually grows your business: generating leads and taking care of your clients. Getting this right isn't just a nice-to-have anymore; it's essential for building a scalable and respected real estate business.

A Real Estate Deal is a Journey: Navigating the 5 Core Stages

Think of a real estate transaction less like a single event and more like a carefully orchestrated journey. Each stage is a critical checkpoint that builds on the last, and keeping everything moving smoothly is the heart of effective transaction management.

The journey doesn't truly begin until an offer is accepted. That moment is the starting gun, kicking off a whole series of deadlines and tasks that need to be managed with precision from day one.

1. Kicking Things Off: Accepted Offer and Opening Escrow

Once the buyer and seller have both signed on the dotted line of the purchase agreement, the deal shifts into high gear. The first order of business is getting that signed contract over to a neutral third party—usually a title or escrow company—to officially open escrow.

What is escrow? It’s basically a secure holding pen for all the money, documents, and instructions involved in the sale. The escrow officer acts as the impartial referee, making sure every single condition in the contract is met before the property and funds change hands. It’s a crucial step that protects everyone involved.

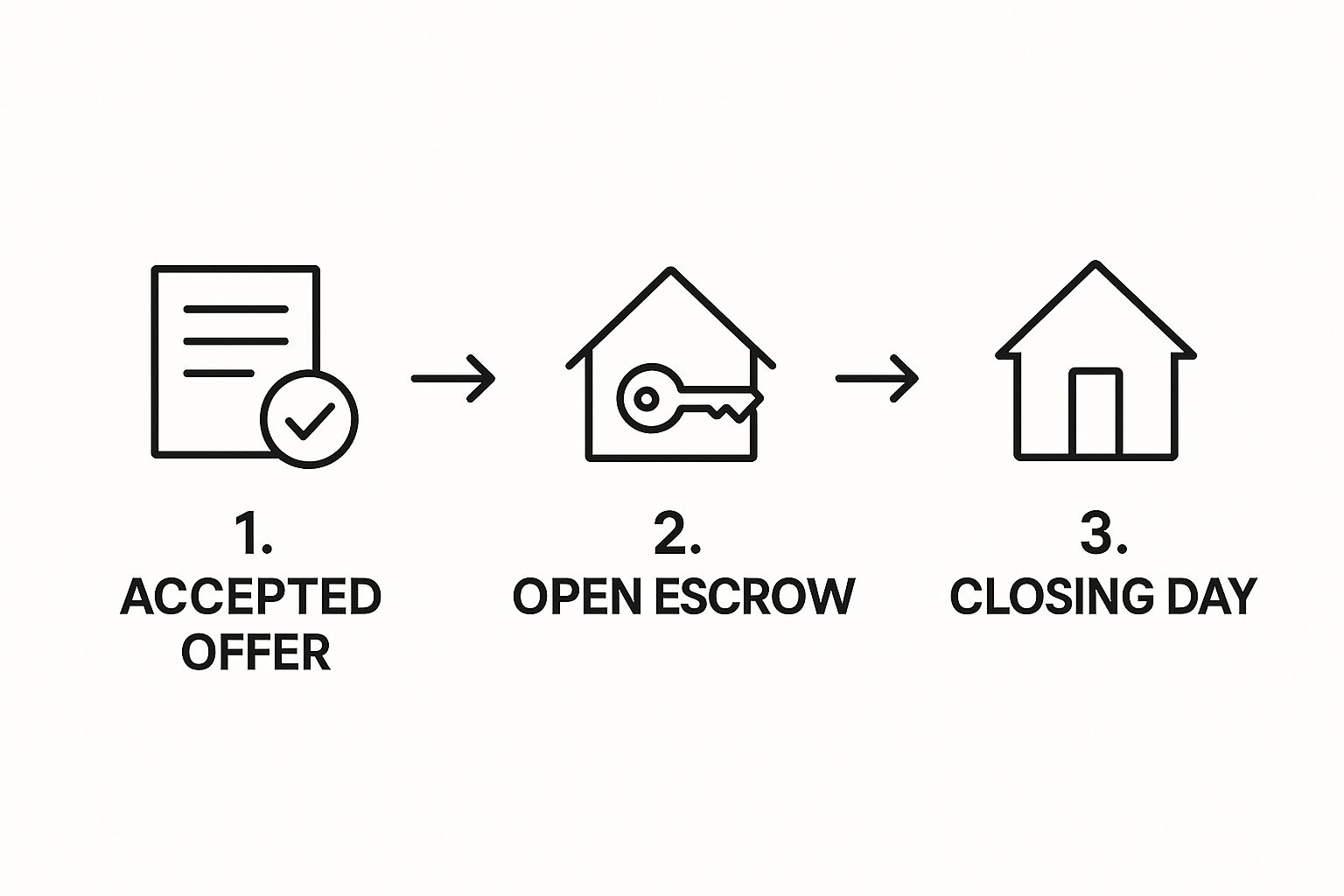

The infographic below gives a great bird's-eye view of the journey, from this initial starting point to the final destination.

This visual really hammers home the structured path of a well-run transaction, highlighting the key milestones from start to finish.

2. The Investigation Phase: Due Diligence and Inspections

With escrow officially open, the clock starts ticking on the buyer’s due diligence period. This is a window of time, defined in the contract, for the buyer to do their homework and thoroughly vet the property. It’s their chance to uncover any potential deal-breakers before they’re locked in.

This stage is all about investigation and includes a few key activities:

Home Inspection: A professional inspector comes in to look at everything—the foundation, the roof, the plumbing, the electrical systems—to spot any hidden defects.

Pest Inspection: This focuses specifically on finding termites, dry rot, or any other wood-destroying pests that could be a major headache down the road.

Reviewing Disclosures: The seller is required to provide a formal list of any known problems with the property. The buyer and their agent will go over this with a fine-tooth comb.

If the inspections turn up something nasty, the buyer can ask the seller to make repairs or even walk away from the deal. A great transaction coordinator ensures these inspections happen quickly and that any negotiations are wrapped up before the deadline hits.

3. Show Me the Money: Securing Financing and the Appraisal

While the property is being poked and prodded, the buyer is busy working with their lender to get the loan finalized. This means submitting a mountain of financial paperwork to get that final, official loan approval.

A make-or-break moment in this stage is the property appraisal. The lender hires an independent appraiser to determine the home's fair market value. They do this to make sure they aren’t lending more money than the property is actually worth.

What happens if the appraisal comes in low? It's a classic snag. The buyer might have to bring more cash to the table, the seller might have to lower the price, or they might try to challenge the appraisal. This is one of those moments where a skilled agent's negotiation and communication skills really shine.

4. Proving Ownership: The Title Search and Insurance

Before a property can legally change hands, the title company has to perform a deep dive into public records. This is called a title search, and its purpose is to confirm the seller actually has the legal right to sell the property and to find any hidden claims against it.

They’re looking for things like unpaid property taxes, liens from contractors, or old ownership disputes. Once they’ve confirmed the title is "clear," the company issues a title insurance policy. This policy is a safety net that protects both the new owner and the lender from any financial losses if a title defect pops up later.

5. The Finish Line: Closing Day and Beyond

Closing day is the culmination of weeks (or months!) of hard work. The buyer and seller sign the last stack of documents, the lender wires the loan funds to escrow, and the seller gets paid. The sheer volume of these closings speaks to the health of the market. For example, the U.S. commercial real estate market saw a massive $115 billion in transactions in just Q2 2023, a testament to how many of these journeys are happening every day. You can discover more insights about CRE transactions and market trends to see the bigger picture.

After all the signatures are dry and the money is moved, the title company officially records the new deed with the county. That's the moment ownership officially transfers, and the buyer finally gets the keys! But the work isn’t over. Post-closing tasks are just as important, like making sure every document is securely archived and sent to the client, agent, and brokerage for their compliance files.

To give you a clearer picture, here’s a breakdown of these phases in a simple table.

Key Stages in a Real Estate Transaction

Stage | Primary Objective | Key Tasks |

|---|---|---|

1. Offer & Escrow | To formalize the agreement and establish a secure process. | Sign purchase agreement, deliver contract to escrow officer, deposit earnest money. |

2. Due Diligence | To allow the buyer to thoroughly investigate the property. | Schedule and review home/pest inspections, analyze seller disclosures, negotiate repairs. |

3. Financing & Appraisal | To secure the buyer's loan and validate the property's value. | Submit loan application and documents, schedule the property appraisal, clear loan conditions. |

4. Title & Insurance | To verify clear ownership and protect against future claims. | Conduct title search, resolve any liens or encumbrances, secure title insurance policy. |

5. Closing | To legally transfer ownership and finalize the financial transaction. | Sign final documents, transfer funds, record the new deed, handle key exchange. |

As you can see, each stage has a distinct purpose and a set of critical tasks that must be completed to move on to the next.

Who's Who in a Real Estate Transaction?

Getting a real estate deal from "for sale" to "sold" is anything but a one-person show. While the buyer and seller are the main characters, an entire cast of specialists works behind the curtain to make it happen. Solid real estate transaction management is all about understanding who does what and how their roles fit together.

Think of it like an orchestra. Each professional plays a different instrument, and the transaction coordinator is the conductor making sure they all play in harmony. If one person is out of tune or misses their cue, the whole performance can fall flat.

The Agents: Your Captains on the Field

Leading the charge are the real estate agents, one for the buyer and one for the seller. They’re the primary strategists and communicators, and their ability to build relationships is just as important as their knack for negotiation. We touch on this early-stage work in our guide on a modern guide to real estate lead management, which is a great place to start.

The Listing Agent: This is the seller's advocate. Their job is to get the property in front of the right buyers, negotiate the best possible terms for the seller, and guide them through their end of the contract.

The Buyer's Agent: As the buyer's champion, this agent hunts down properties, crafts compelling offers, and steers the buyer through the maze of inspections, financing, and paperwork.

These two are the main points of contact, constantly relaying information between their clients and the rest of the team to keep the deal moving forward.

The Transaction Coordinator: The Deal's Project Manager

The Transaction Coordinator (TC) is the unsung hero of almost every smooth closing. They are the organizational powerhouse who tracks every document, chases every signature, and makes sure every deadline is hit. A great TC is the glue that holds the entire process together.

They do more than just check boxes on a list. A proactive TC anticipates problems, coordinating with lenders and title companies to smooth out bumps in the road before they become full-blown roadblocks. Their attention to detail allows agents to do what they do best: serve their clients.

The Financial and Legal Crew

This group handles the money and the legal paperwork, ensuring the transaction is both financially viable and legally sound. There's no room for error here; their precision is absolutely critical.

The Key Money and Title Players:

The Lender or Mortgage Broker: This is where the money comes from. The lender vets the buyer's finances and appraises the property to make sure it's worth the loan amount.

The Escrow Officer: This neutral third party acts like a secure vault, holding onto the buyer's funds and all the important documents. They only release everything once all contract conditions are met by both sides, ensuring a fair exchange.

The Title Representative: This expert is a property historian. They dig into public records to make sure the seller has the clear, legal right to sell the property, uncovering any hidden claims or liens that could cause problems for the new owner.

Each of these roles depends on the others. The escrow officer can’t close the deal without the lender’s final approval, and the lender won’t give that approval without a clean report from the title company.

The Property Inspectors and Appraisers

Before the deal is sealed, a few more experts step in to assess the property's physical health and its market value. Their objective reports can make or break a deal, or at least send everyone back to the negotiating table.

The Home Inspector: Hired by the buyer, this professional does a deep dive into the home’s condition, from the foundation to the roof. They'll point out everything from a leaky faucet to major structural issues, giving the buyer a brutally honest look at their potential purchase.

The Appraiser: The lender brings in an appraiser to give an unbiased, expert opinion on the property's value. This is a crucial step—a lender simply won't loan more money than what the appraiser says the home is worth.

Let's face it: even the smoothest-looking real estate deals can hit rough patches. With so many moving parts, different people involved, and tight timelines, it’s easy for something to fall through the cracks and jeopardize a closing. The real skill in real estate transaction management isn't about having zero problems—it's about seeing them coming and tackling them head-on before they blow up.

These aren't just local headaches, either. They're happening everywhere. In the second quarter of 2025 alone, direct real estate transaction volumes hit a staggering $179 billion, partly fueled by a major increase in cross-border deals. In fact, foreign investment into the U.S. jumped by 26%. When that much money is on the line, there’s zero room for error. You can get a better sense of these trends by checking out JLL's global real estate transaction data.

So, let's dig into the most common hurdles that trip people up and, more importantly, how to clear them.

The Black Hole of Communication

Nothing sours a deal faster than radio silence. When a client, lender, or the agent on the other side of the table feels out of the loop, they get anxious. Trust starts to break down. A single missed email or an unreturned phone call can send ripples of doubt and delay through the entire process.

The Solution: Create a Central Hub for Everything

Stop letting vital information get buried in scattered email chains and text messages. The key is to create one single source of truth for the transaction. This could be a client portal built into your software or a shared project board where everyone can log in. The point is to give every single person involved a clear, real-time view of the deal's status, upcoming dates, and important documents. It cuts down on the endless back-and-forth and keeps everyone feeling confident and informed.

The Tyranny of Missed Deadlines

A real estate contract is built on a foundation of critical, legally-binding dates. The inspection contingency, the loan approval deadline, the final closing date—these aren't just friendly suggestions. Missing one can blow up the entire contract, potentially costing your client their dream home and creating a massive financial mess.

The Solution: Automate Your Calendar and Checklists

You can't rely on memory alone, especially when you're juggling multiple transactions. It's time to let technology handle the heavy lifting.

Standardized Checklists: Build out a master template for every type of deal you do (buyers, sellers, rentals, etc.). This list should include every single task and deadline from the moment the contract is signed until the keys are handed over.

Automated Reminders: Use your transaction management software or even a shared Google Calendar to set up multiple alerts for every important date. These reminders should go to you, your team, and even your client when appropriate.

When you systemize how you track deadlines, you take the stress out of the equation. It goes from being a constant source of worry to a reliable, automated process that keeps you ahead of schedule instead of constantly playing catch-up.

Document Disorganization and Compliance Chaos

Think about how many documents a single deal generates: the offer, disclosures, inspection reports, loan paperwork, addenda... the list goes on. A messy digital file isn't just an annoyance; it’s a serious compliance risk. If an auditor—or worse, a lawyer—comes knocking, "I think it's in an email somewhere" is not an acceptable answer.

The Solution: Build a Bulletproof Digital Filing System

The fix is simple but powerful: create a standard folder structure for every single transaction and stick to it. Using a secure, cloud-based system ensures that every document has a specific home and can be found in seconds by anyone on your team who needs it.

Example Digital Folder Structure:

01_Purchase_Documents: This is for the executed contract, any counteroffers, and all addenda.

02_Disclosures: All seller and state-required disclosure forms live here.

03_Escrow_and_Title: Store the preliminary title report, escrow instructions, and the final settlement statement.

04_Inspections: This holds every inspection report and any related repair requests or agreements.

05_Loan_Documents: This is where you'll find the loan approval, the appraisal, and the closing disclosure.

An organized system like this doesn't just keep you sane; it creates a complete, audit-proof file for every deal you close. It turns the nightmare of compliance into a simple, repeatable part of your workflow.

How Technology Breathes Life into Transaction Workflows

If you're still running your transactions with a spreadsheet and a chaotic web of email chains, you know the feeling. It's a recipe for missed deadlines, costly errors, and total burnout. To actually grow a real estate business today, you have to stop thinking of technology as an add-on—it has to be your core strategy.

Modern real estate transaction management software takes the entire process from a reactive, high-stress scramble to a proactive, organized system. Think of it as the central nervous system for your deals. Instead of having crucial information scattered across inboxes, text messages, and notepads, everything flows into one command center. This hub handles the grunt work, tracks every milestone in real time, and gives everyone involved a clear picture of what's happening and what's next.

This isn't just about convenience; it's about keeping up. The real estate market is getting more competitive and attracting serious investment. Deloitte's 2026 outlook points to a major recovery, with nearly 75% of global commercial real estate respondents planning to ramp up their investments. That kind of volume demands an efficiency that manual methods just can't deliver. You can dig into the factors driving this investment growth on Deloitte.com to see the full picture.

So, how exactly does this technology change the game? It really boils down to three key areas.

H3: Centralizing Communication and Documents

The biggest immediate impact of good transaction software is centralization. It creates a single, secure, cloud-based home for every contract, disclosure, and addendum related to a deal. This one change instantly solves the nightmare of document chaos.

You'll never have to dig through your inbox at 10 PM looking for the "final_final_v3" version of a repair request again. Instead, agents, clients, transaction coordinators, and lenders can all access the right file, right now. This approach also pulls in all communication, logging messages and updates within the transaction file itself. The result is a permanent, auditable record of the entire deal.

A centralized platform is your single source of truth. It eliminates the "he said, she said" confusion by creating one official record for every document, conversation, and deadline, ensuring everyone operates from the same playbook.

H3: Automating the Administrative Burden

Let’s be honest: repetitive admin work is the enemy of growth. It’s a time-suck, and it’s where most mistakes happen. Technology tackles this head-on by automating the tasks that eat up your day, freeing you to focus on client relationships and closing more deals.

Here's where you'll feel the difference:

Automated Deadline Reminders: The software intelligently scans contract dates and automatically populates a calendar with every critical deadline, sending out reminders to all the right people. No more manual calendar entries.

Task List Generation: As soon as a deal goes under contract, the system can generate a complete checklist of tasks based on your custom templates.

Integrated E-Signatures: Sending documents out for signature becomes a simple one-click process, completely removing the need to print, scan, or juggle a separate e-signature service.

By taking these manual chores off your plate, you can also integrate other powerful tools. For instance, good real estate marketing automation can manage client communication from the lead stage, creating a smooth journey from first contact all the way through closing.

H3: Enhancing Client Transparency and Experience

Today's clients expect instant access to information. They want to know what's going on without having to constantly ask. Technology delivers this with client portals, which give buyers and sellers 24/7 access to their transaction status.

Through a secure login, your clients can see what's due next, review documents that need their attention, and watch the progress bar move toward closing. This level of transparency dramatically reduces client anxiety and cuts down on those "just checking in" calls and emails. It transforms the experience from one of uncertainty to one of empowerment and confidence.

These systems work by talking to each other behind the scenes. To get a better handle on how all the pieces connect, you can check out our simple explanation of what is software integration.

Manual vs. Tech-Enabled Transaction Management

The difference between a traditional, manual approach and a modern, tech-enabled one is night and day. One is about reacting to problems, while the other is about preventing them from happening in the first place. This table breaks down the core distinctions.

Aspect | Manual Process | Tech-Enabled Process |

|---|---|---|

Document Control | Files scattered across email, cloud drives, and physical folders. Version confusion is common. | A single, centralized hub for all documents with clear version history. The "single source of truth." |

Deadline Tracking | Relies on manual calendar entries and personal reminders. Prone to human error. | Automated deadline calculation and reminders sent to all stakeholders. Greatly reduces missed dates. |

Communication | Disjointed conversations via phone, text, and email. No single record of the conversation. | Centralized communication log tied directly to the transaction file, creating an auditable trail. |

Client Experience | Clients must call or email for updates, leading to anxiety and a reactive relationship. | A 24/7 client portal provides real-time status updates, empowering clients and building trust. |

Efficiency | High administrative overhead, with hours spent on repetitive data entry and follow-ups. | Automation handles checklists, reminders, and data entry, freeing up agents for high-value tasks. |

Compliance | Difficult to maintain a complete and auditable file, increasing risk. | Every action, document, and communication is logged automatically, ensuring a compliant record. |

Ultimately, adopting technology isn't just about doing the same things faster. It's about fundamentally changing how you manage transactions to be more accurate, more transparent, and far more scalable.

Best Practices for Flawless Transactions

Getting to the closing table smoothly time and time again isn't about luck—it's about having a rock-solid system in place. When you adopt a core set of best practices, you can turn the typical chaos of real estate transaction management into a predictable, repeatable process.

This is what separates the top producers from everyone else. They build frameworks that reduce stress, delight clients, and allow their business to scale.

Develop Standard Operating Procedures

Think of a Standard Operating Procedure (SOP) as your personal playbook for every single deal. It’s a living document that spells out every task, every deadline, and every communication touchpoint from the moment a contract is signed to the day the keys are handed over.

A well-crafted SOP means every transaction gets the same meticulous level of attention, no matter how hectic your schedule gets. It removes the guesswork and ensures that you and your team are always on the same page, which is essential for maintaining quality as you grow.

An SOP is more than just a checklist. It's your promise of professionalism, ensuring the client's experience is consistently excellent, not just a roll of the dice depending on the deal.

Implement Proactive Communication

Your clients should never have to ask, "What's next?" A proactive communication plan is all about anticipating their questions and keeping everyone in the loop—the client, the cooperating agent, the lender, and the title company.

This can be as simple as setting up automated email templates for key milestones. A quick note confirming the earnest money was deposited or a reminder about the upcoming inspection deadline goes a long way. It builds trust and makes your clients feel genuinely looked after.

Conduct Regular Audits and Maintain a Master Calendar

In real estate, compliance is everything. Regular file audits are your best defense against costly mistakes. Set aside time at least once a week to review your active transaction files. Are all signatures in place? Are documents dated correctly and filed properly? For a more detailed guide, check out these 9 document management best practices for 2025.

At the same time, you need a master calendar. This gives you a high-level view of every critical date across all your pending deals. Think of it as your command center, preventing crucial deadlines from ever falling through the cracks. Protecting the information itself is just as important, which is why understanding essential data management best practices is a critical skill. By weaving these habits into your workflow, you build a powerful structure for executing flawless transactions, every single time.

Frequently Asked Questions

Jumping into the nitty-gritty of real estate transaction management often brings up a few key questions. Let's tackle some of the most common ones I hear from agents and brokers.

What’s the Difference Between a Transaction Coordinator and a Real Estate Agent?

Think of it as a movie set. The real estate agent is the director—they find the talent (the client), negotiate the vision (the deal), and are the main face of the production. They’re out there making the magic happen.

The transaction coordinator (TC) is the producer working behind the scenes. Once the "action" is called (the contract is signed), they jump in to manage the entire production schedule. They’re the ones wrangling all the paperwork, hitting every deadline, and coordinating with the crew—lenders, title companies, inspectors—to make sure the whole project comes together flawlessly and on time.

Is Transaction Management Software Worth It for a Solo Agent?

Without a doubt. I often see solo agents drowning in the very tasks that are holding their business back. It's easy to think of software as just another expense, but it's really an investment in your own sanity and growth.

This kind of tool acts like a virtual assistant that never sleeps. It automates your checklists, pings you about deadlines, and keeps all your client communication and documents in one tidy place.

For a solo agent, this isn't just about efficiency—it's about scalability. It's how you go from handling a few deals with white knuckles to managing a higher volume smoothly, all without dropping a single ball.

Can I Manage a Real Estate Transaction Without a Professional?

You can, but it's like trying to navigate a minefield without a map. Real estate contracts are complex legal instruments loaded with state-specific disclosures, strict deadlines, and dozens of potential pitfalls.

One missed signature or a blown contingency deadline can unravel the entire deal, or worse, land you in legal hot water. A professional transaction manager brings a proven system and a deep well of experience to the table, acting as a crucial safety net for both you and your client.

What Is the Most Critical Skill for a Transaction Manager?

Organization is the price of entry, but the skill that separates the good from the great is proactive problem-solving.

A truly exceptional transaction manager is always playing chess, not checkers. They don't just react to problems; they see them coming from three steps away. They'll notice a tight financing deadline and are already on the phone with the lender days before it becomes a fire drill. This forward-thinking mindset is what turns potential deal-killing disasters into minor, easily-handled bumps in the road.

Ready to stop chasing paperwork and start closing deals more efficiently? Flow Genius designs and implements custom automation workflows that give you back your time. Learn how we can build your perfect transaction system.