Top 9 Invoice Automation Software Solutions for 2025

- Matthew Amann

- Jun 14, 2025

- 13 min read

Revolutionizing Your Accounts Payable: A Guide to Invoice Automation Software

Drowning in paperwork? Struggling to keep up with invoice processing? This listicle explores leading invoice automation software solutions to help streamline your accounts payable department. We'll cover key features, pricing, pros, cons, and integrations for top platforms like SAP Concur, Bill.com, Basware, AppZen, Stampli, Tipalti, Yooz, Coupa, and Sage Intacct.

This guide helps you:

Identify the right invoice automation software for your specific business needs.

Understand the core functionalities and benefits of each platform.

Compare pricing tiers and choose the most cost-effective option.

Improve your AP processes, reducing errors and saving time.

Free up valuable resources to focus on strategic initiatives.

Efficient invoice processing is crucial for maintaining healthy cash flow and accurate financial reporting. Manual data entry is time-consuming and prone to errors. Invoice automation software minimizes these risks while improving overall efficiency. For processing invoices automatically, consider using an AI tool like the one provided by Invoice AI Scanner. This type of tool can extract key data from invoices, further automating your workflow. Choosing the right software can significantly impact your bottom line, regardless of your industry – from infrastructure project management and software development to energy, logistics, and even commercial cleaning. This roundup will equip you with the knowledge to make an informed decision and transform your AP department.

1. SAP Concur

SAP Concur stands out as a leading invoice automation software solution, particularly for enterprise-level organizations. This comprehensive platform tackles both expense management and invoice automation, leveraging AI and machine learning to streamline accounts payable processes. A key strength of SAP Concur lies in its seamless integration with existing SAP ERP systems, making it a natural fit for businesses already within the SAP ecosystem. Beyond automation, it provides robust compliance features, crucial for navigating complex regulatory landscapes. Invoice automation can be seen as a specific type of business process automation. For more details on broader applications, see these examples of business process automation.

Benefits of SAP Concur

Implementing SAP Concur offers a multitude of benefits, including:

Reduced invoice processing time: Automation eliminates manual data entry and routing, freeing up staff for higher-value tasks.

Improved accuracy: Automation minimizes human error, leading to more accurate invoice processing.

Enhanced visibility: Real-time dashboards provide a clear overview of invoice status and potential bottlenecks.

Strengthened compliance: Built-in controls ensure adherence to regulatory requirements.

Real-world Success with SAP Concur

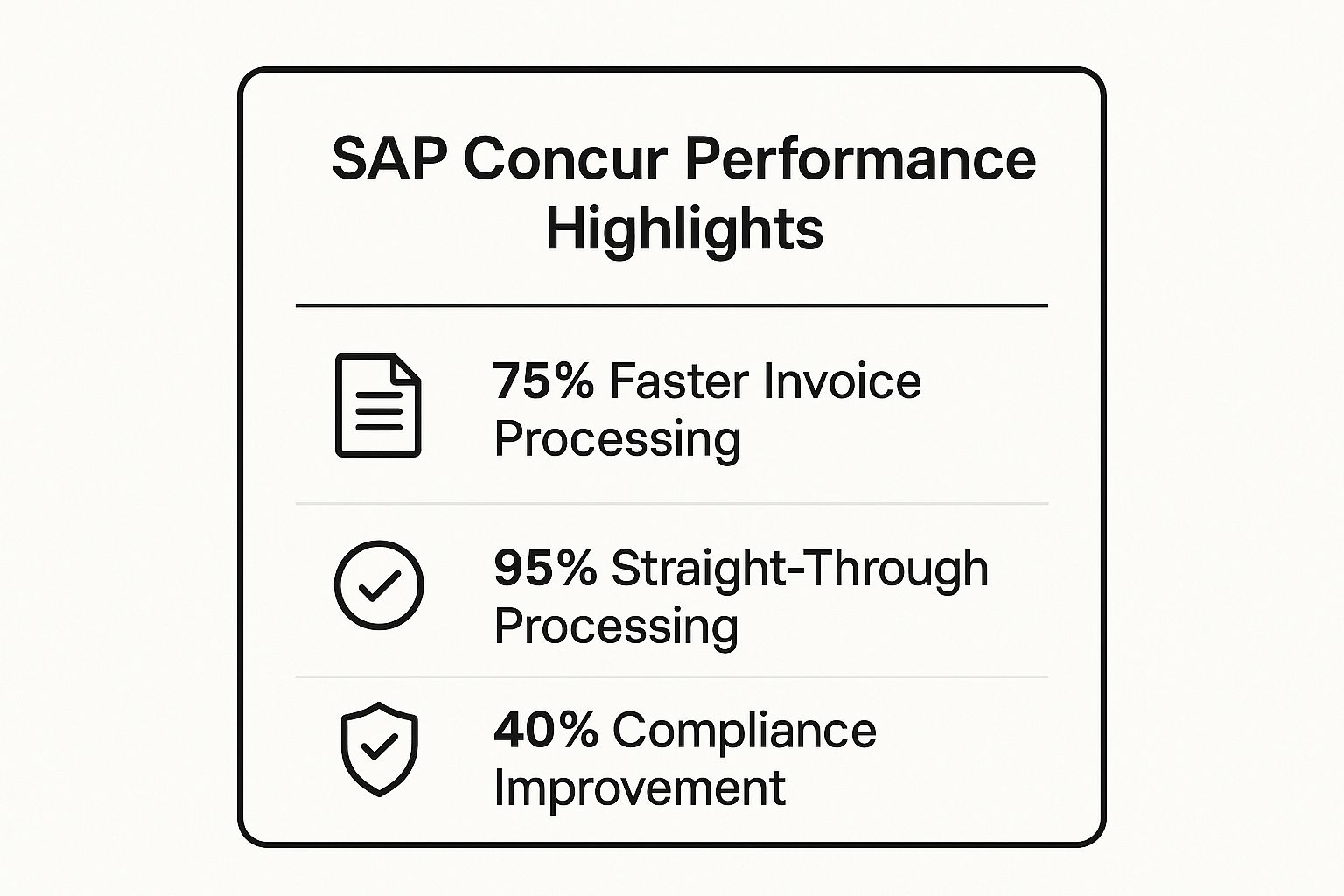

Several major corporations have successfully implemented SAP Concur to achieve significant improvements in their accounts payable processes. Siemens, for example, reduced invoice processing time by a remarkable 75%. Johnson Controls achieved 95% straight-through processing, and Deutsche Post DHL improved compliance by 40%. These examples highlight the tangible benefits achievable with the right invoice automation software. The following infographic visualizes key performance data from these implementations.

As the infographic demonstrates, SAP Concur can significantly boost efficiency and compliance in invoice processing. These improvements translate to cost savings and reduced risk for organizations.

Tips for Successful Implementation

To maximize the benefits of SAP Concur, consider these actionable tips:

Pilot program: Start with a pilot program in one department to test and refine your implementation strategy.

User training: Invest in comprehensive user training and change management to ensure smooth adoption.

Workflow configuration: Configure approval workflows to match your existing processes for seamless integration.

Analytics dashboard: Leverage the analytics dashboard for continuous improvement and data-driven decision-making.

2. Bill.com

Bill.com is a cloud-based accounts payable (AP) and accounts receivable (AR) platform designed for small to medium-sized businesses (SMBs). It automates the entire invoice lifecycle, from receipt and approval to payment and reconciliation, offering intuitive workflows and seamless bank integrations. Bill.com allows businesses to manage their cash flow more effectively, reducing the time and resources spent on manual processes. Learn more about how to automate data entry and save time with platforms like Bill.com. Learn more about...

Benefits of Bill.com

Implementing Bill.com offers several advantages, particularly for SMBs looking to streamline their financial operations:

Reduced processing time: Automation eliminates manual data entry, routing, and reconciliation, freeing up staff for more strategic tasks.

Improved accuracy: Automation minimizes human error, leading to more accurate invoice processing and financial reporting.

Enhanced visibility: Real-time dashboards provide a clear overview of invoice status, cash flow, and potential bottlenecks.

Streamlined approvals: Automated approval workflows ensure timely invoice processing and reduce payment delays.

Real-world Success with Bill.com

Many companies have successfully implemented Bill.com to optimize their AP processes. Restoration Hardware reduced AP processing time by 50%. Planet Fitness streamlined multi-location invoice management, improving visibility and control. Stanford University improved vendor payment efficiency by an impressive 60%.

Tips for Successful Implementation

To maximize the benefits of Bill.com, consider these tips:

Automated approval rules: Set up automated approval rules from day one to streamline invoice routing and minimize delays.

Vendor portal: Use the vendor portal to reduce manual data entry and improve vendor collaboration.

Payment batches: Schedule regular payment batches to optimize cash flow and minimize transaction fees.

Accounting software integration: Integrate with existing accounting software early in the implementation process for seamless data synchronization.

3. Basware

Basware is a global leader in networked purchase-to-pay solutions and e-invoicing, serving large enterprises with complex procurement needs. This platform offers one of the world's largest open business networks, connecting over 1 million companies globally. Basware leverages AI-driven invoice processing to automate and streamline accounts payable, improving efficiency and reducing costs. Its focus on global supplier collaboration makes it particularly well-suited for multinational organizations. Invoice automation enhances business process automation within accounts payable.

Benefits of Basware

Implementing Basware offers several key benefits:

Touchless invoice processing: AI and machine learning automate invoice capture, coding, and routing, minimizing manual intervention.

Global supplier network: Streamlined collaboration with suppliers worldwide simplifies procurement processes.

Improved visibility: Real-time analytics dashboards provide insights into invoice status, spend analysis, and supplier performance.

Reduced errors: Automation minimizes human error, ensuring greater accuracy in invoice processing.

Real-world Success with Basware

Many prominent companies have leveraged Basware to achieve significant improvements. Nokia, for instance, achieved 80% touchless invoice processing. The City of Helsinki successfully digitized its municipal procurement processes. Volvo Group also improved supplier collaboration on a global scale. These examples demonstrate the potential for substantial efficiency gains through Basware's platform.

Tips for Successful Implementation

For a successful Basware implementation, consider these tips:

Plan for a longer implementation timeline: Given the complexity of integrating with a large supplier network, a realistic timeframe of 6-12 months is recommended.

Maximize ROI through supplier network: Actively encourage supplier onboarding to fully leverage the network effect and achieve maximum return on investment.

Focus on change management: Effective change management across departments is crucial for smooth adoption and user buy-in.

Utilize analytics: Leverage Basware's analytics dashboards to make strategic procurement decisions based on data-driven insights.

4. AppZen

AppZen is an AI-driven spend management platform that automates expense reports, invoices, and contracts. It leverages artificial intelligence to audit these documents, identifying errors and potential fraud. Its advanced machine learning algorithms are particularly adept at ensuring compliance with company policies and regulatory requirements. For companies looking to streamline their financial processes and mitigate risk, AppZen offers a powerful solution.

AppZen goes beyond basic invoice automation software by proactively identifying and mitigating potential issues before they impact the bottom line. This makes it a valuable tool for any organization seeking to improve financial control and efficiency. If you are interested in automation consulting, learn more about AppZen and other solutions.

Benefits of AppZen

Implementing AppZen offers several significant advantages:

Fraud detection: AI algorithms identify anomalies and potential fraud, protecting the organization from financial losses.

Compliance assurance: The platform ensures adherence to internal policies and external regulations, minimizing risk.

Automated auditing: Expense reports and invoices are automatically audited, reducing manual effort and improving efficiency.

Real-time insights: Dashboards provide real-time visibility into spending patterns and potential issues.

Real-world Success with AppZen

Several companies have successfully implemented AppZen, realizing substantial benefits. Palantir Technologies reduced expense audit time by an impressive 95%. ServiceNow improved compliance accuracy by 87%. Coupa Software achieved 100% expense report auditing. These examples demonstrate the power of AI-driven spend management in action.

Tips for Successful Implementation

To maximize the value of AppZen, consider the following tips:

Pilot program: Begin with a pilot program to demonstrate ROI and refine your implementation strategy.

AI configuration: Configure the AI models to align with specific company policies and industry regulations.

Policy refinement: Utilize insights from AppZen to refine existing expense policies and improve compliance.

Integration strategy: Combine AppZen with other accounts payable solutions for end-to-end automation.

5. Stampli

Stampli distinguishes itself as a collaborative invoice automation software solution, particularly well-suited for businesses prioritizing communication and streamlined approvals. This platform centers around invoice management, leveraging AI for efficient processing while uniquely integrating email communication directly into the workflow. This fosters real-time collaboration between stakeholders, ensuring everyone stays informed throughout the approval process. Invoice automation improves accounts payable processes, a crucial aspect of financial management.

Benefits of Stampli

Implementing Stampli offers numerous advantages:

Reduced invoice processing time: Automation minimizes manual tasks, allowing for faster approvals.

Improved communication: Integrated email keeps all stakeholders informed and engaged.

Enhanced visibility: Real-time tracking provides clear insight into invoice status.

Simplified collaboration: Centralized platform facilitates seamless communication and collaboration.

Real-world Success with Stampli

Several organizations have leveraged Stampli to transform their accounts payable processes. AMN Healthcare reportedly reduced invoice processing time by 70%, showcasing the platform's efficiency. The University of California system improved multi-location coordination by centralizing invoice management through Stampli. Hard Rock International also streamlined restaurant operations using the platform, demonstrating its adaptability across various industries.

Tips for Successful Implementation

To maximize Stampli’s benefits, consider these practical tips:

Leverage email integration: Encourage users to embrace the email integration for a smooth transition and easy adoption.

Collaborative workflows: Establish clear collaborative workflows early in the implementation process to maximize efficiency.

Mobile app utilization: Encourage the use of the mobile app to expedite approvals and enhance accessibility.

Customer success team: Take full advantage of the customer success team's expertise for optimization and support.

6. Tipalti

Tipalti is a comprehensive accounts payable automation platform designed for scaling businesses, particularly those with global operations. This robust software excels in handling complex payment scenarios, navigating international tax compliance, and streamlining supplier management across multiple countries and currencies. It offers a centralized platform for managing the entire invoice lifecycle, from initial receipt to final payment, reducing manual intervention and improving efficiency. This makes it an ideal invoice automation software solution for businesses with complex global payment needs.

Benefits of Tipalti

Implementing Tipalti offers several advantages for businesses:

Automated global payments: Streamlines payments to suppliers in various countries and currencies, reducing the complexity and cost of international transactions.

Simplified tax compliance: Automates tax calculations and withholding, minimizing the risk of errors and penalties.

Improved supplier relationships: Provides a self-service portal for suppliers, enhancing communication and transparency.

Enhanced visibility and control: Offers real-time insights into invoice processing and payment status, giving businesses greater control over their finances.

Real-world Success with Tipalti

Several high-growth companies have leveraged Tipalti to optimize their accounts payable processes. GoDaddy, for instance, streamlined payments to over 10,000 suppliers using the platform. Roku automated global marketplace payments, and even Twitter (pre-acquisition) managed creator payments at scale with Tipalti. These examples demonstrate the software's ability to handle high volumes of transactions and complex payment scenarios effectively.

Tips for Successful Implementation

To maximize the benefits of Tipalti, consider the following tips:

Map out global compliance requirements: Clearly define your international tax obligations before implementation to ensure seamless configuration.

Utilize supplier self-service portal: Encourage suppliers to use the self-service portal for onboarding and information updates, reducing manual data entry and improving accuracy.

Set up automated tax calculations early: Configure automated tax calculations from the outset to minimize compliance risks and streamline payment processing.

Leverage analytics for supplier relationship optimization: Utilize the platform's analytics capabilities to gain insights into supplier performance and identify opportunities for improvement.

7. Yooz

Yooz stands out as a user-friendly, AI-powered invoice automation software solution designed specifically for mid-market companies. This cloud-based purchase-to-pay platform leverages artificial intelligence to streamline the entire invoice processing lifecycle, from data capture and approval routing to payment execution and archiving. Originally from France, Yooz has expanded its presence globally and is known for its robust AI capabilities and intuitive interface. Companies seeking to implement invoice automation as a key component of their broader business process automation strategy will find Yooz to be a valuable tool.

Benefits of Yooz

Implementing Yooz offers several key advantages:

Reduced processing costs: AI-driven automation minimizes manual data entry and speeds up invoice processing, leading to significant cost reductions.

Improved efficiency: Automated workflows and approvals streamline operations, freeing up staff for higher-value tasks.

Enhanced visibility: Real-time dashboards and reporting tools provide clear insights into invoice status, potential bottlenecks, and overall performance.

Greater accuracy: Automated data extraction and validation reduce human error, resulting in more accurate invoice processing.

Real-world Success with Yooz

Yooz has helped numerous companies achieve significant improvements in their accounts payable processes. ENGIE, a global energy company, reduced invoice processing costs by an impressive 60% after implementing Yooz. Groupe Partouche, a leading casino operator, leveraged Yooz to improve efficiency across multiple locations. Various European municipalities have also adopted Yooz to digitize their procurement processes, demonstrating its versatility across different sectors.

Tips for Successful Implementation

To maximize the benefits of Yooz, consider these actionable tips:

AI learning: Take advantage of Yooz's AI learning capabilities from day one to optimize data extraction and automation accuracy.

Workflow configuration: Configure approval workflows to match your existing organizational hierarchies for seamless integration.

Mobile approval: Utilize the mobile app to enable remote approvals and accelerate the invoice processing cycle.

Multi-language support: Leverage multi-language features to support international operations and streamline cross-border transactions.

8. Coupa

Coupa is a comprehensive spend management platform that includes robust invoice automation software capabilities. As part of its broader Business Spend Management (BSM) suite, Coupa is designed for large enterprises seeking to optimize their entire procure-to-pay process. It leverages advanced analytics and AI to drive efficiency and cost savings. Coupa helps businesses gain control over all spending, from sourcing to payment.

Benefits of Coupa

Coupa offers a range of benefits for businesses looking to automate their invoice processing:

Reduced processing costs: Automation eliminates manual tasks, significantly lowering processing costs.

Improved spend visibility: Real-time dashboards and reporting provide insights into spending patterns.

Enhanced compliance: Automated controls ensure adherence to internal policies and regulatory requirements.

Supplier relationship management: Coupa's platform facilitates collaboration and communication with suppliers.

Real-world Success with Coupa

Several large organizations have leveraged Coupa to transform their spend management processes. Salesforce, for example, achieved $50 million in cost savings by implementing Coupa. UNICEF improved procurement transparency globally, and Airbus streamlined its complex supplier relationships. These examples demonstrate the potential for significant improvements with a comprehensive spend management platform.

Tips for Successful Implementation

To maximize the benefits of Coupa, consider these actionable tips:

Start with core AP modules: Begin by implementing the core accounts payable modules before expanding to other areas of spend management.

Leverage spend analytics: Use Coupa's spend analytics tools to gain strategic insights into spending patterns and identify areas for optimization.

Invest in user training: Comprehensive user training and change management are crucial for successful adoption.

Use supplier network: Leverage Coupa's extensive supplier network to maximize value and streamline procurement processes.

9. Sage Intacct

Sage Intacct offers robust invoice automation as a core component of its cloud-based financial management platform. It's a particularly strong choice for organizations needing tight integration between their accounting system and AP automation, providing real-time financial visibility and control. This integration streamlines processes and eliminates data silos, ensuring financial data accuracy and facilitating informed decision-making. Learn more about how automation can revolutionize document management and contract approvals with automation: Learn more about....

Benefits of Sage Intacct

Sage Intacct delivers several key benefits for businesses seeking to automate invoice processing:

Real-time Visibility: Gain immediate insights into financial performance with real-time dashboards and reporting.

Improved Accuracy: Reduce errors and improve data integrity through automated data entry and validation.

Streamlined Processes: Automate invoice routing, approvals, and payment processing for increased efficiency.

Enhanced Control: Strengthen financial controls and ensure compliance with built-in audit trails.

Real-world Success with Sage Intacct

Numerous organizations have leveraged Sage Intacct to optimize their financial operations. Avalara, a tax compliance software provider, streamlined their financial close processes using Sage Intacct. Barry-Wehmiller, a global manufacturing company, enhanced multi-entity reporting and gained greater financial insights. Various non-profit organizations have also implemented Sage Intacct, achieving improved grant tracking and financial management.

Tips for Successful Implementation

To ensure a smooth and successful Sage Intacct implementation, consider these tips:

Accounting Team Involvement: Actively involve your accounting team throughout the implementation process for valuable input and buy-in.

Dimensional Reporting: Configure dimensional reporting to gain deeper insights into your financial data.

Real-Time Dashboards: Utilize real-time dashboards for proactive cash flow management.

Audit Features: Leverage built-in audit features to meet compliance requirements and maintain data integrity.

Invoice Automation Software Feature Comparison

Solution | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

SAP Concur | High complexity; steep learning curve | High IT and training investment | Up to 75% faster invoice processing; strong compliance | Large enterprises with SAP ERP integration | Advanced AI, strong compliance, scalable |

Bill.com | Low to moderate; user-friendly | Moderate; good onboarding support | 50% reduction in AP processing time | Small to medium businesses (SMBs) | Easy setup, strong QuickBooks integration |

Basware | Very high; long timelines | High IT and professional services | 80% touchless invoice processing | Large global enterprises with complex P2P | Extensive global network, strong compliance |

AppZen | Moderate; relatively quick ROI | Moderate IT integration | 95% expense audit time reduction | Companies focused on audit & fraud detection | Industry-leading AI, fraud detection |

Stampli | Low to moderate; fast adoption | Low to moderate | 70% faster invoice processing | Mid-market, collaborative AP workflows | Email-like UI, strong collaboration |

Tipalti | Moderate to high; complex setup | Moderate to high | Streamlined global payments | Scaling businesses with global payments | Global payments, strong tax compliance |

Yooz | Moderate; quick adoption | Moderate | 60% reduction in invoice processing | Mid-market with European presence | Strong AI, user-friendly, flexible |

Coupa | High complexity; long timelines | High IT and change management | Large cost savings, improved transparency | Large enterprises preferring full spend mgmt | Comprehensive platform, strong analytics |

Sage Intacct | Moderate; requires accounting integration | Moderate with accounting involvement | Improved financial close and reporting | Organizations needing tight accounting-AP integration | Strong financial reporting, audit features |

Choosing the Right Invoice Automation Software for Your Business

Navigating the world of invoice automation software can feel overwhelming with so many options available. This article has explored nine leading solutions, from established players like SAP Concur and Bill.com to innovative platforms like AppZen and Stampli. Each offers a unique set of features, pricing structures, and integration capabilities. By understanding these differences, you can make a more informed decision for your business.

Key Takeaways and Considerations

Several crucial themes emerged from our exploration of these invoice automation tools. Security and compliance are paramount, especially for industries with strict regulatory requirements. Integration with existing accounting software, ERP systems, and other business tools is essential for seamless data flow and operational efficiency. Scalability is another key factor, ensuring the chosen software can grow with your business.

Invoice Volume: High-volume processing requires robust automation features and potentially higher pricing tiers.

Industry-Specific Needs: Some solutions cater to specific industries, offering tailored functionalities. For instance, construction businesses might prioritize lien waiver management, while real estate brokers could benefit from automated commission calculations.

User Experience: Intuitive interfaces and ease of use are vital for efficient adoption and minimal training time.

Making the Decision

Selecting the optimal invoice automation software requires careful consideration of your specific business needs and budget. Start by clearly defining your pain points and desired outcomes. Do you aim to eliminate manual data entry errors? Accelerate invoice processing times? Improve cash flow visibility?

When evaluating Sage Intacct, it is helpful to understand other products in the Sage family, such as Sage 300 Accounting Software. This can provide a broader perspective on Sage's ecosystem of business management tools.

Once you’ve identified your priorities, evaluate each software’s ability to address them. Consider factors such as:

Company Size: Small businesses may benefit from simpler, more affordable solutions, while larger enterprises require more robust features.

Integration Requirements: Ensure seamless integration with your existing accounting and ERP systems.

Desired Level of Automation: Some platforms offer basic data extraction, while others provide end-to-end invoice processing automation.

The Power of Automated Workflows

Mastering the art of invoice automation empowers your business to streamline operations, reduce costs, and free up valuable time for strategic initiatives. By eliminating manual processes, you minimize errors, improve accuracy, and enhance overall efficiency. This improved financial control leads to better decision-making and increased profitability. Whether you're a roofing contractor managing project expenses or a technology company integrating its software ecosystem, invoice automation software offers tangible benefits across diverse industries.

Looking for even more advanced workflow automation? Explore Flow Genius to further streamline your processes. Flow Genius can complement and extend your chosen invoice automation software, enabling custom integrations and automated workflows for increased efficiency across your entire organization.