- Oct 11, 2025

- 12 min read

Automating repetitive tasks is about using technology to handle those recurring, manual jobs that eat up your day. Think of it as creating a digital assistant that never gets tired, never makes a copy-paste error, and frees you up to focus on the work that actually requires your brainpower. The end goal? A huge boost in productivity and, frankly, a much more satisfying workday.

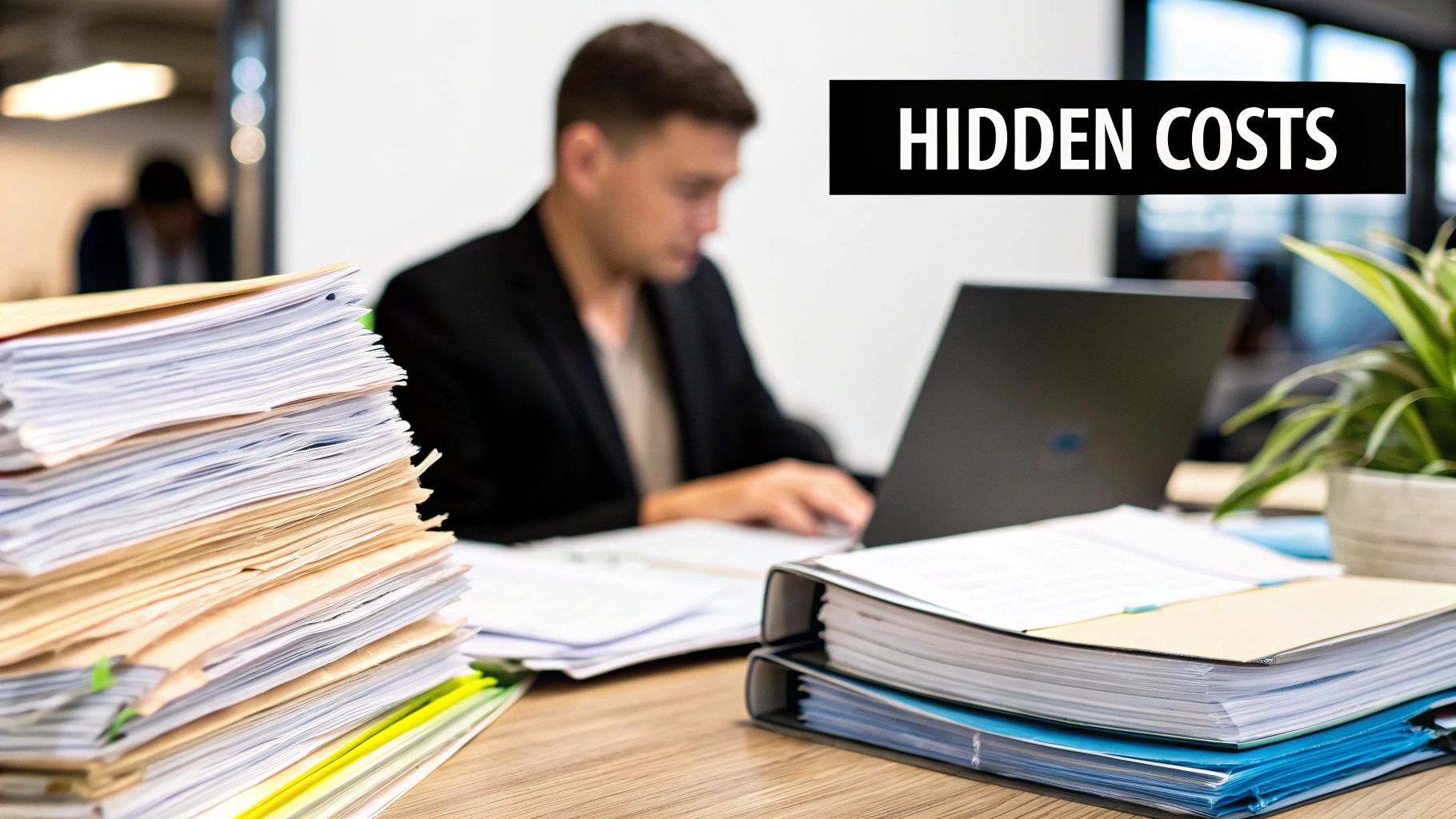

The Hidden Costs of Repetitive Work

Those mind-numbing tasks are more than just boring; they're a quiet drain on your most important resources. Every minute you spend manually moving data between spreadsheets, sending the same follow-up email, or pulling a routine report is a minute you could have spent on creative problem-solving or high-level strategy.

This isn't just about lost time—it's about the hit to morale that leads straight to burnout. When your team is stuck in a cycle of monotony, their creative spark dims. Instead of tackling big challenges, their energy gets sapped by low-value activities. This is also where costly human errors creep in. A single typo or a forgotten step can snowball into bigger problems, from skewed data to lost sales.

The Real Impact on Business Growth

The fallout from manual work goes way beyond individual frustration. For the business, it creates operational logjams that slow down everything from onboarding new clients to closing the books each month. That inefficiency puts a hard ceiling on your growth and profitability. The first step to fixing this is to understand how you can reclaim your time by automating repetitive tasks.

This isn't just a feeling; the numbers back it up. A staggering 94% of companies admit their employees spend time on repetitive, time-consuming tasks. This contributes to 68% of workers feeling swamped by their daily workload—a problem automation is perfectly suited to solve.

The good news? When automation is introduced, 89% of employees report higher job satisfaction.

Why Automation Is a Strategic Advantage

Making the choice to automate repetitive tasks isn't just a simple productivity trick anymore. It's a core business strategy that builds a more resilient and scalable operation. By creating systems for the mundane, you establish a baseline of consistency, reliability, and efficiency.

The true goal of automation isn't to replace humans, but to amplify their capabilities. It handles the 'what' and the 'how' so you can focus on the 'why' and the 'what's next.'

This shift lets your team pour their expertise into work that actually moves the needle. You can learn more about the specific advantages in our guide on the top benefits of automating business processes in 2025. Embracing automation is how you build a smarter, more agile organization that's ready for whatever comes next.

Finding and Mapping Your Automation Targets

Before you can start building automations, you need to know exactly what you’re trying to fix. The best automations aren't born from complex theories; they come from identifying the specific, nagging problems you face every single day. The first step is a simple audit of your own work.

Don't just guess where your time goes. For one week, keep a "task diary." Just a few notes every hour about what you're working on is all it takes. This isn't about productivity shaming—it's about gathering real-world data. You'll be surprised by the patterns that pop out, showing you precisely where the hours are being spent.

Spotting Your Best Opportunities

With your task list in hand, you can start hunting for the low-hanging fruit. Your best targets are always the tasks that are both frequent and predictable.

To zero in on the perfect candidates, ask yourself these questions for each activity:

Is it routine? Do I find myself doing this exact same thing every day or every week?

Is it rule-based? Could I write a step-by-step guide for someone else to do this task without any creative input?

Does it involve moving data? Am I just copying and pasting information from one app to another?

If you answered "yes" to any of these, you’ve found a prime candidate for automation. Think about things like manually compiling weekly reports or saving attachments from specific emails into a project folder. Those are your gold mines.

The litmus test for a great automation opportunity is simple: if a process is so predictable that you can do it on autopilot, then a computer can do it better and faster. This frees up your mental energy for complex problem-solving.

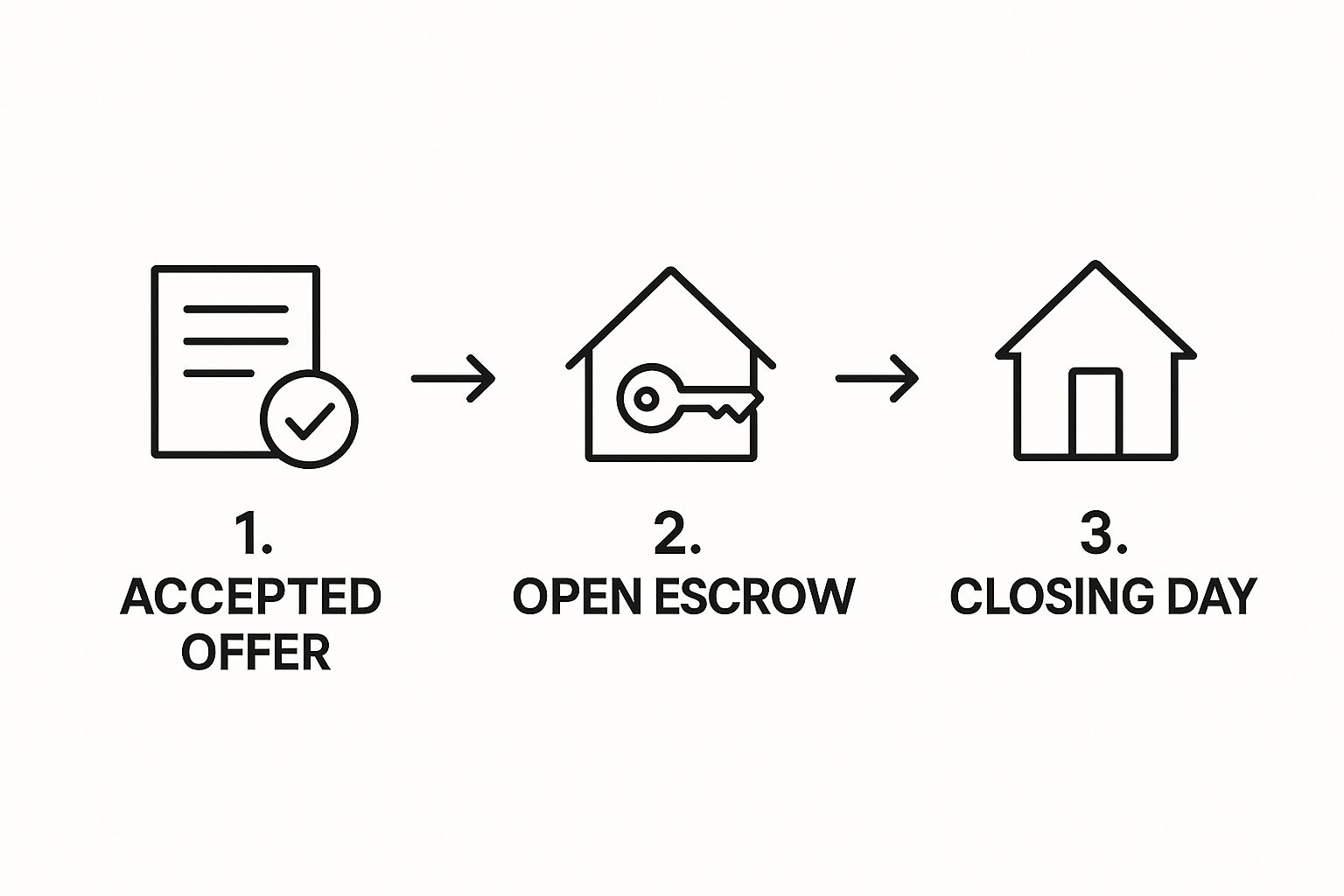

Visualizing Your Workflow

Now it’s time to sketch out the process. This sounds technical, but it’s really not. Grab a whiteboard or even just a piece of paper and draw out the steps of one of those repetitive tasks from beginning to end.

Let’s imagine you're mapping out your new client onboarding process. It might look something like this:

A new client signs their contract in your e-signature tool.

You have to manually set up a new project for them in Asana or Trello.

Then, you go over to Google Drive to create a new shared folder.

Finally, you draft and send a canned welcome email with links to their project board and shared folder.

Laying it all out visually makes the clunky handoffs between different apps jump right off the page. Each of those manual steps is where an automation can slot in perfectly. By spotting these bottlenecks, you’re not just finding tasks to automate—you're actually designing a more elegant and efficient system from the ground up. You’ve just created the blueprint for your first successful workflow.

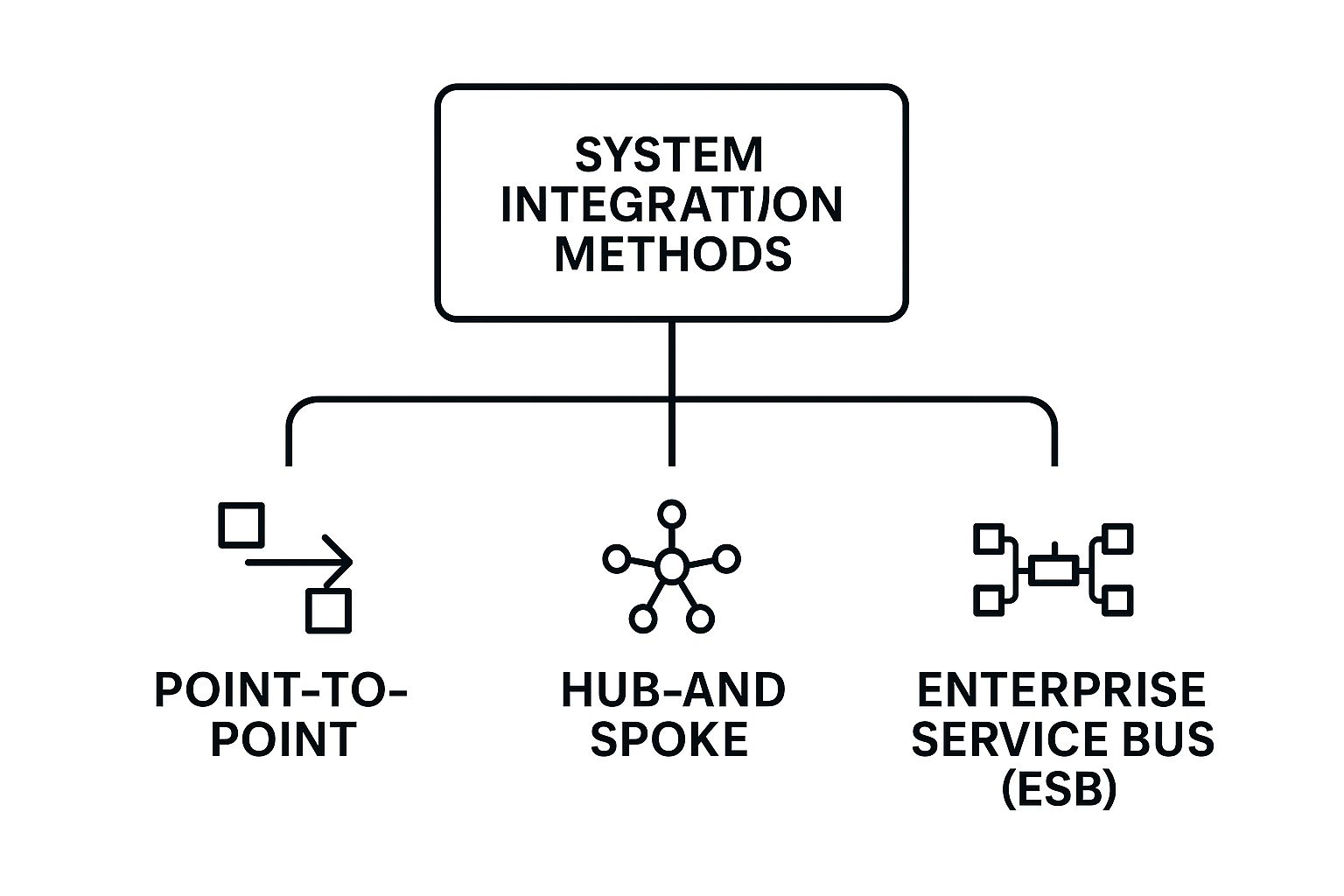

Choosing the Right Automation Tools for the Job

Once you've mapped out your workflow, the next step is picking your toolkit. The world of automation software is huge, but I've found it helps to think of the options in three main categories. This approach cuts through the noise and lets you match the right type of tool to the task at hand.

The market for this stuff is booming—it's expected to hit $18.45 billion by 2025. What's driving this? Mostly, the rise of low-code and no-code platforms. In fact, estimates suggest that 70% of new business applications will be built using these simpler tools. This is great news because it means you no longer need to be a developer to automate repetitive tasks.

This simple decision tree can help you figure out where to start.

By figuring out your needs first, you can avoid getting bogged down by the sheer number of options out there.

No-Code Integration Platforms

Think of these as the Swiss Army knives of the automation world. Platforms like Zapier, Make.com, and n8n are designed to act as the glue between all your different apps. They let you build powerful workflows without touching a single line of code.

Their biggest advantage is their versatility. You can connect your email to your project management tool, your CRM to a spreadsheet, or a contact form to your calendar, usually in just a few clicks. For a detailed breakdown of the best options, take a look at our guide to the top workflow automation tools for 2025 success.

Best for: Connecting different apps, non-technical users, and getting results fast.

Example: Automatically creating a Trello card whenever you star a new email in Gmail.

Built-In Automation Features

Before you go searching for a new tool, take a look at the software you're already using every day. You might be surprised by the powerful automation features hiding right under your nose.

Many modern applications have their own native automation capabilities. For example, project management software like Asana has "Rules" that can automatically assign tasks or update a project's status. Most CRMs have built-in workflows for lead nurturing or sending follow-up reminders.

The real beauty of built-in automation is how seamless it is. Because it's a native part of the platform, you don't have to worry about broken connections or managing a third-party service.

These features are perfect for any process that happens entirely within a single piece of software.

Custom Scripts and APIs

When off-the-shelf tools just can't get the job done, it's time to roll up your sleeves. If you have some technical skills (or know someone who does), you can write custom scripts for ultimate control. Using languages like Python or JavaScript, you can connect directly to an application's API (Application Programming Interface).

This route opens the door to incredibly specific solutions that packaged tools can't handle. It definitely takes more effort to set up, but it gives you the power to manage complex logic, transform data in unique ways, and build integrations that are a perfect fit for your exact needs.

Best for: Highly specific or complex tasks, processing massive amounts of data, or situations where other tools just aren't flexible enough.

Example: Writing a script that pulls data from an internal database, formats it into a custom PDF report, and emails it to the management team every morning at 8 AM sharp.

Building Your First Workflow from Scratch

Alright, enough with the theory—let's get our hands dirty. The quickest way to truly grasp workflow automation is to build one yourself. We’re going to walk through creating a simple, yet incredibly practical workflow using a tool like Zapier as our guide.

Imagine this common scenario: you need to save all email attachments from a key client into a specific cloud folder. This kind of manual drag-and-drop can quietly steal hours from your month. By automating it, you’ll see just how powerful this process can be and get the confidence to tackle your own unique bottlenecks.

If you need some inspiration before we begin, checking out some practical marketing automation workflow examples can give you a great head start.

The Starting Pistol: Setting Up Your Trigger

Every single automation kicks off with a trigger. This is the specific event that tells your workflow, "GO!" You're essentially teaching the system what to look out for.

In our example, the trigger is a new email landing in your inbox. But we don't want just any email setting this off; that would be chaos. We need to be specific.

Here’s how we’d set the conditions:

App: Gmail (or whatever email service you use)

Trigger Event: New Email Matching Search

Search String:

That simple line of text is a powerful filter. It tells the system to only pay attention when an email arrives from our designated client and—crucially—it must have a file attached. This kind of precision is what makes an automation a reliable assistant instead of just more digital noise.

The Main Event: Defining Your Action

Once the trigger fires, the action is the job you want done. It’s the "then what?" part of the process. If the trigger is the cause, the action is the effect you want to create.

For this workflow, our action is to grab that attachment and save it to a designated cloud storage folder. You’ll connect your Google Drive or Dropbox account and then point the automation to the exact folder where you want the files to live.

The magic of these no-code tools is how they move data between steps. You can instruct the action to take the actual attachment from the trigger email and save it. You can even get fancy and tell it to use the email's subject line to name the file automatically.

This seamless handoff of information is what makes these automations so effective. We explore this concept in more detail in our full guide on no-code workflow automation.

The Final Check: Testing and Going Live

I can't stress this enough: never, ever turn on a new workflow without testing it. This is your safety check—a chance to spot mistakes before they cause real headaches. Thankfully, most automation platforms have a built-in testing function.

The test will find a recent piece of data that matches your trigger (like a recent client email with an attachment) and run it through your action steps. You can then pop over to your cloud folder and confirm the file showed up, named correctly and ready to go.

Once you’re sure it's running smoothly, you flip the switch to "On." And just like that, you've created a digital assistant that will handle this task 24/7, freeing up your time and making sure an important file never gets buried in your inbox again.

Testing and Refining Your Automated Workflows

Building an automation and just walking away is a classic rookie mistake. I learned that the hard way early on. The real work—and the real magic—begins after you flip the switch to "On." This is where you turn a functional workflow into a truly reliable system that hums along in the background.

Think of it like launching a new piece of software. You wouldn't just ship it without hunting for bugs first, right? The same logic applies here. Every new workflow needs to be put through its paces to make sure it holds up under real-world pressure.

This isn't just a "nice-to-have" step; it's critical. An estimated 70% of digital transformation projects, including automation, don't quite hit their targets. It's rarely because the initial idea was flawed. More often, it's due to skimpy testing and a failure to adapt as things change. You can find more stats on automation project success rates to see just how common this is.

Your Essential Testing Checklist

Before I let any new automation run loose on my actual work, I put it through a simple but effective checklist. The whole point is to catch glitches before they can cause any real headaches.

First, run a few live tests with real, but non-critical, data. Going back to our email attachment example, you'd send an email from a personal account that perfectly matches the trigger conditions. Did the file show up in the right Google Drive folder? Was it named correctly?

Then, you have to try and break it. What happens if an email arrives with no attachment at all? Or what if a client sends a file with a weird symbol like "#" in the name? These are what we call edge cases—those oddball scenarios you don't expect but can easily trip up a brittle workflow.

Here’s what a solid testing process looks like:

The "Happy Path": This is your best-case scenario. Does the workflow run perfectly when everything goes exactly as planned? This confirms your core logic is sound.

The "Failure Path": Now, what happens when things go wrong? Purposely send data that should cause an error. You want to see how the system handles the failure, not if it fails.

Edge Case Scenarios: Get creative. Test with unusual inputs like files with super long names, emails with five attachments instead of one, or even a blank subject line.

Understanding Error Logs and Alerts

Look, no automation is perfect forever. Sooner or later, one of them will hiccup. When it does, your new best friend is the error log or run history. Platforms like Zapier or Make.com give you a detailed play-by-play of every run, showing you exactly which step failed and, hopefully, why.

Don't wait around for something to break, though. Get into the habit of setting up failure notifications from day one. Most tools let you add a final step to your workflow that shoots you an email or a Slack message the instant an error pops up. This simple action shifts you from being a reactive firefighter to a proactive system manager.

An automation that fails silently is far more dangerous than one that doesn't run at all. Proactive monitoring and alerts are your safety net, ensuring you catch small problems before they snowball into big ones.

Finally, schedule time for a quick check-up. Once a quarter, I take a few minutes to glance at my most important automations. Are all the app connections still good? Has a platform updated its API? This small maintenance habit ensures your efforts to automate repetitive tasks keep paying dividends long after you first set them up. It’s how you build a resilient system that actually gets better over time.

Have Questions About Automation? Let's Clear Them Up.

Jumping into automation for the first time always brings up a few questions. It's totally normal to wonder about the cost, how steep the learning curve is, and what kind of impact it'll actually have on your day-to-day. So, let's tackle some of the most common questions I hear from people who are just starting to automate repetitive tasks.

Is This Going to Be Expensive?

This is usually the first thing people ask, and the answer is almost always a pleasant surprise: not really. In fact, you can get started for free.

Many of the best tools out there, like Zapier and Make.com, have surprisingly powerful free plans. These are more than enough to get your first few automations up and running, letting you test the waters without spending a dime.

When you do decide to upgrade, think about the return on your investment. If a $25 per month plan saves you just a couple of hours of mind-numbing work, it's already paid for itself. My advice is always to start small, get a few easy wins under your belt, and then scale up once you see the proof for yourself.

Is Automation Going to Replace My Job?

I hear this a lot, but I see it completely differently. Automation doesn't replace talented people; it replaces the tedious clicks that get in the way of their real work. It’s all about offloading the boring stuff so you can focus on what a computer can't do.

The goal is to free you from being a human copy-and-paste machine. Automation elevates your work, letting you focus on strategic thinking, creative problem-solving, and building relationships—the stuff that actually makes you invaluable.

Honestly, learning to automate your own workflows makes you a more valuable asset to your team, not a less essential one.

What's the Easiest Thing to Automate First?

The trick to getting started is to aim for a quick, satisfying win. You want something that builds momentum and shows you the magic of automation right away.

Your best first candidates will always have these three things in common:

Simple Logic: The task is a straightforward, "if this happens, then do that" kind of process.

High Frequency: It's something you're forced to do every single day, or at least multiple times a week.

Low Stakes: If it messes up while you're still learning, it’s not the end of the world.

A few classics are things like automatically sharing new blog posts to social media, saving form submissions from your website straight into a Google Sheet, or turning a starred email into a task in your to-do list app.

How Can I Be Sure My Automation Is Actually Working?

The golden rule here is "trust, but verify." Never just switch an automation on and assume it's running flawlessly.

Every good automation platform has a "run history" or a "log" that shows you a play-by-play of every time it ran. This is your best friend for spotting successes and tracking down any errors.

For the first few times a new workflow runs, I always double-check the outcome myself. For example, if I built something to save attachments to a specific folder, I’ll go look in that folder to make sure the file is really there. A pro-tip is to add a final step to the automation that pings you with a Slack message or an email, just to say, "Hey, I finished the job."

Ready to stop wasting time on manual work and start building a more efficient business? The experts at Flow Genius specialize in designing and implementing custom automation solutions that give you back your most valuable asset—your time. Book a discovery call today and find out how much you can achieve when you automate the mundane.